El Ministerio de Salud y la Protección Social certifica a DIAGNÓSTICO E IMÁGENES DEL VALLE IPS S.A.S. Se encuentra habilitada para prestar los servicios de salud.

Adoptado mediante circular 0076 de 02 de Noviembre de 2007

Blog

Really does Mortgage Prequalification Apply at Your credit rating?

On this page:

- How does Home loan Prequalification Work?

- Is home financing Prequalification Connect with The Borrowing from the bank?

- The way to get The Borrowing from the bank Able to own home financing

- Screen The Borrowing When shopping to have a property

Taking prequalified to own home financing more than likely wouldn’t apply to your borrowing from the bank, however it helps you decide how much you can borrow. Generally, the newest prequalification process is quick and you may easy. Once a loan provider product reviews the basic credit and you can financial suggestions, it will know if you’re likely to be eligible for a mortgage, the sorts of mortgages you can aquire and limit number you can acquire.

How come Home loan Prequalification Functions?

A home loan prequalification can be a first rung on the ladder whenever you are looking to purchase a property. The procedure may vary of the bank, nevertheless can expect to-be required some basic advice regarding the financial predicament. Eg, a loan provider should find out about your income, the monthly obligations, exactly how much you have saved getting a down-payment and how far we want to acquire.

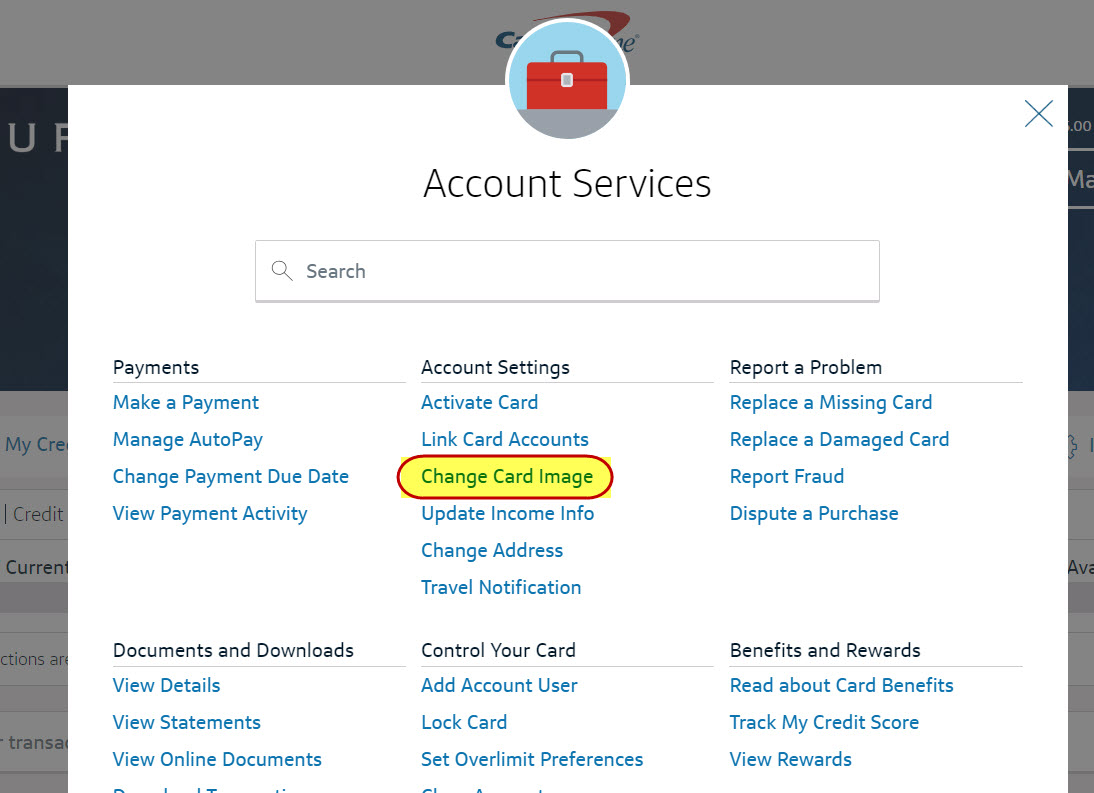

Some loan providers can also determine their credit with a mellow inquiry-a variety of credit assessment that will not effect credit scores-or request your estimated credit rating range. You can get a totally free FICO Rating ? 8 away from Experian to make use of once the an approximation, even in the event lenders tend to use old FICO Score models.

Facts your money and borrowing from the bank helps a lender dictate the mortgage count you can afford to blow back and the danger you establish since a debtor. In accordance with the recommendations it look for, the financial institution is prequalify your for different sorts of mortgage loans and a projected loan amount. You may also discover an effective prequalification letter, which you’ll give home sellers and you will real estate agents to exhibit which you yourself can likely be able to purchase a home.

Normally a home loan Prequalification Apply at Your own Credit?

Provided the borrowed funds prequalification only requires you to show an estimated credit rating, or even the lender checks the borrowing that have a flaccid eliminate, your borrowing from the bank may not be impacted.

But not, since the lenders generally cannot be certain that your details to own financial prequalification, this may just offer you a harsh estimate. Whenever you are prepared to do something and have you might be significant, you could attempt locate preapproved getting home financing instead.

Mortgage preapprovals would be different than prequalifications. They have a tendency is alot more tight-much like the actual mortgage software process-and require confirmation documents, like copies off spend stubs, lender statements and you can taxation statements. Mortgage preapproval may want an arduous credit assessment, and therefore getting preapproved to possess a mortgage get hurt the borrowing from the bank. You should know, not, the credit history damage for the a single difficult query, if you have one after all, would be limited and you will short-term.

Nonetheless, bringing preapproved would be smart while you are willing to generate an offer, while the you’ll have an even more specific notion of the sort of home loan and you can count you could potentially be eligible for to your bank. Along with, inside competitive casing locations, becoming preapproved you are going to leave you a leg up with sellers exactly who have to deal with now offers regarding customers they understand can follow through for the promote.

(Know that specific lenders both use the terms preapproval and you can prequalification interchangeably, and you might not score what you assume away from an effective preapproval. If a lender will bring good preapproval instead of verifying every piece of information you shared or examining their borrowing from the bank, it can be quicker specific and bring smaller weight than simply one to one considers using good credit for medical school loan a detailed economic image.)

How to get Their Borrowing Ready to possess a home loan

On weeks leading up to your home buy, you could make chance to work with boosting your borrowing from the bank. Their credit reports and you can ratings can affect your ability to locate a mortgage along with your mortgage’s interest, and also you desire to be on finest condition you can easily. Listed below are some steps you can take to arrange:

- Look at your credit. If you haven’t done so already, look at your credit scores knowing where you’re. As well as, feedback your credit history out of every three credit bureaus to own activities which are often hauling down their score. Past-owed membership and you will membership for the selections might have a huge feeling in your score, very try everything you could potentially to quit destroyed costs and also to catch up At the earliest opportunity if you do. If you have people charges-off profile on your own statement, do something to address her or him.

- Reduce your own mastercard balances. The borrowing use, which tips just how their rotating membership balances compare to its credit restrictions, is another essential rating grounds. Paying down revolving balance, such as for instance personal credit card debt, is reduce your application rates, which can only help your fico scores. Even although you pay their mastercard statement entirely for every single times, your debts tends to be said after the report months and you may end up in a leading utilization rates. And also make costs through to the avoid of your own battery charging months may help you keep their borrowing utilization reduced.

- Never apply for the brand new account. Starting another type of mastercard or mortgage is also harm your borrowing from the bank scores as it can reduce your mediocre ages of profile and you may produce a challenging query. Brand new accounts helps you build borrowing when you find yourself while making costs timely, and these quick-term setbacks generally are not a primary question. Yet not, it can be best to end starting brand new accounts on days leading up to your mortgage software.

- Spend most of the statement punctually. A late commission can damage your own credit ratings, particularly when it first goes. Because the lead up to purchasing a house is busy, make sure you do not skip people expenses payments. If you don’t currently take action, you may want to put up automatic repayments otherwise notification to possess costs due dates.

Display Their Credit While shopping getting a property

Whilst getting prequalified to possess a home loan may well not apply to your own borrowing from the bank results, we would like to make certain most other negative scratching usually do not harm their borrowing prior to you make an application for particularly a large mortgage. A card monitoring solution you certainly will quickly alert you in order to changes in your credit reports. Experian now offers totally free track of your own Experian credit history.

You are able to screen your own most other several credit history as better, once the mortgage brokers may use most of the three of your own records and you may credit scores based on each declaration. The fresh Experian IdentityWorks SM Superior program possess a totally free 31-go out demo and you may is sold with three-bureau overseeing and multiple FICO Scores each declaration, like the FICO Get variation popular getting lenders.