El Ministerio de Salud y la Protección Social certifica a DIAGNÓSTICO E IMÁGENES DEL VALLE IPS S.A.S. Se encuentra habilitada para prestar los servicios de salud.

Adoptado mediante circular 0076 de 02 de Noviembre de 2007

El Ministerio de Salud y la Protección Social certifica a DIAGNÓSTICO E IMÁGENES DEL VALLE IPS S.A.S. Se encuentra habilitada para prestar los servicios de salud.

Adoptado mediante circular 0076 de 02 de Noviembre de 2007

There are many different home loan possibilities that allow Indiana homeowners to buy a home with little to no down payment. Traditional mortgage loans constantly called for good 5% -20% advance payment, which is okay for lots more knowledgeable homebuyers, but out of reach on the mediocre earliest-date people.

Brand new Government Housing Government (FHA) has become the most common choice for its wider availability. Once the average household visitors s, he/she may well not see the differences. For each option sells its specific group of standards that or may not fit the brand new applicant’s requires.

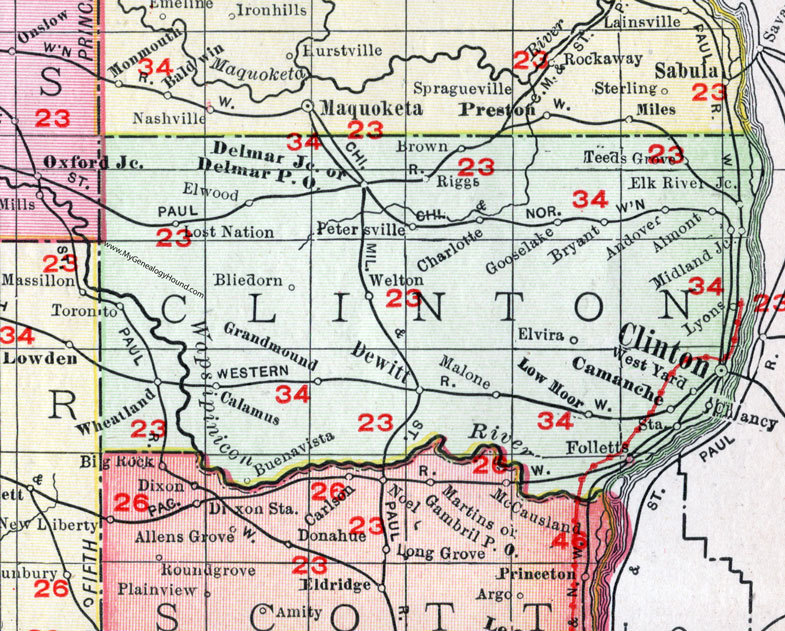

An effective USDA home loan is supported by the us Agencies out of Farming (USDA Rural Homes) and considering through acknowledged loan providers and banking institutions. These funds are specially geared to so much more outlying qualified places. Indiana continues to have of numerous metropolises and you can suburbs felt USDA eligible, see the USDA eligibility map here.

This new USDA 502 program allows to 100% of one’s appraised property value the house no advance payment needed. The home can be one relocate position house, it simply needs to be based in an approved urban area according for the map above. Note, existing mobile belongings and you may land/parcel funds are not allowed. An additional benefit with USDA financing, this new month-to-month financial insurance is shorter in comparison to Traditional otherwise FHA loans. Together with keep in mind that USDA comes with household money limitations, realize most of the seem to requested USDA concerns right here.

If you’re a seasoned otherwise newest active obligations, the new Virtual assistant financing could be the most suitable choice on the market. Low-rates, 100% resource, and you may borrowing from the bank liberty to name a few benefits. Va offers zero downpayment mortgage loans doing $647,200 for accepted Vets nationwide. Simultaneously, there can be another type of Va Jumbo financing to own customers which need higher financing wide variety. The newest Virtual assistant Jumbo is obtainable up to $step one.5m, but this method will demand a little downpayment. Qualified attributes are solitary-household members residential property, condominiums and you may townhomes. Virtual assistant fund feature safe fix speed words and no prepayment punishment.

Typically the most popular first-big date client system inside Indiana remains the Federal Casing Management (FHA) mortgage. This is some other government-backed system that’s paid because of the You.S. Company off Property and you can Urban Development. In comparison with USDA and Virtual assistant, the FHA program is one of well-known and you will widely used. FHA fund wanted simply step three.5 % downpayment no constraints to the home income or place. The credit get and you will underwriting advice is actually faster firm as opposed to those to possess a traditional mortgage. The consumer can be put down as little as step three.5% down-payment, however, a good 600 credit score are expected quite often.

The newest annual superior is normally .85% of your own loan amount split up more than good several-week months. Additionally, FHA fund need a 1.75% upfront money payment which are rolled on the borrower’s mortgage. FHA, as with any others programs listed above, is only available to buyers whom reside the house given that a number one house. Financial support belongings and you can travel residential property aren’t let. Buyers can also be read a list of the best FHA Financing Q&An indeed there https://www.paydayloanalabama.com/gallant/.

A traditional mortgage is considered the most prominent brand of home finance. Lenders require consumer to get down 5-20% of your own cost. The consumer has to be considered inside the lender’s financial obligation-to-earnings proportion. The fresh ratio having house costs (prominent, interest, taxation, and you may insurance coverage) should be no more 35% of the buyer’s terrible monthly income. The latest ratio restriction getting homes plus standard bills should not be any more than forty-five% of your own buyer’s gross monthly money.

The buyer need certainly to introduce proof he has money available for the latest down-payment. Delight create note the brand new ratio limitations over is surpassed getting solid customers which have good credit, stable business record, cash savings. Credit ratings getting conventional financing can be significantly more than 620. Conventional money come in several fixed price and flexible adjustable-rate terms and conditions.

A normal home loan was positive where a borrower starts out having no less than 20% deposit and certainly will stop individual home loan insurance rates (PMI) or any funding fee as with any government entities financing want. The downside would be the fact saving you to definitely enough for very highest a beneficial down-payment takes a lot of time. FHA finance provide the self-reliance to find property which have less cash down.

There are even no earnings otherwise area limits having FHA (such as for example USDA) USDA fund feel the minimum strict guidance, however you should be looking an outlying home specifically and has a family earnings underneath the restrict for the city. USDA & Va are really the only financial apps today that let 100% money.

Must find out more? Please e mail us at amount above, or perhaps fill out the info Consult Means in this post. We’re offered to serve you seven days a week.

Offering Indianapolis, Fort Wayne, Evansville, Southern Bend, Carmel, Fishers, Bloomington, Hammond, Gary, Lafayette, Muncie, Terre Haute, Noblesville, Kokomo, Anderson, Greenwood, Elkhart, Mishawaka, Lawrence, Columbus, Jeffersonville, Western Lafayette, Portage, New Albany